Important Advisory

What’s changing?

As we transition to a more streamlined and unified digital experience with the new Maxicare Member Gateway, the MaxiHealth+ app will be officially decommissioned on December 31, 2025, and the Maxicare Multifunction Card’s withdrawal feature will be discontinued on February 1, 2026. All the features you love, such as viewing your Maxicare e-card, video consultation, crediting of reimbursement requests, and more will now be available in the new and improved Member Gateway.

What should you do now?

- – Log in to your MaxiHealth+ app to review your Maxicare Multifunction Card and e-wallet balances.

- – Withdraw your card balance via ATM/POS or transfer it to your personal account via the MaxiHealth+ App.

- – Activate your account on the new Member Gateway to continue enjoying your Maxicare benefits.

For questions and assistance regarding the MaxiHealth+ app and Maxicare Multifunction Card, please contact us at maxihealthplusgeneralinquiry@maxicare.com.ph.

Member Gateway FAQs

The new Member Gateway is a modern web application designed to make your health journey easier. It replaces the old Member Gateway and MaxiHealth+ apps, providing you with easier booking, quicker access to your medical records and transactions, convenient reimbursement submission, and streamlined LOA requests.

2. Who can use the new Member Gateway?

The new Member Gateway is available for principal members and their adult dependents.

3. Can a minor dependent create a new Member Gateway account?

No, minor dependents cannot create their own accounts. All requests for minor dependents must be handled by the principal member.

4. What types of accounts can access the new Member Gateway?

The new Member Gateway can be accessed by members with corporate accounts, SME accounts, and MyMaxicare accounts (individual and family).

5. Do I still need to register?

Yes, getting started is easy! To register for the new Member Gateway, follow these steps:

- Visit the Maxicare website, click the Member Section, then select Member Gateway

- On the login page, click Activate Member Gateway Account

- Read the welcome message and click Get Started

- Register using your Maxicare Card, or use your Employee ID and Company Code if you don’t have the card yet

- Fill in the required details, agree to the Terms & Conditions, then click Activate

- Enter the OTP sent via SMS to verify your mobile number

- You’re done! You’ve successfully activated your Member Gateway account

For more details, please visit this link:

New Member Gateway Member Guide (refer to slide 5 to 6)

6. What is a company code and where do I get it?

A company code is a unique identifier for your organization. You can get it from your HR representative.

7. What is an employee code and where do I get it?

Like the company code, the employee code is a unique identifier within your company which you can request from your HR representative.

8. What features are available in the new Member Gateway?

The new Member Gateway allows you to do the following features:

- – Visit the Maxicare website, click the Member Section, then select Member Gateway

- – On the login page, click Activate Member Gateway Account

- – Read the welcome message and click Get Started

- – Register using your Maxicare Card, or use your Employee ID and Company Code if you don’t have the card yet

- – Fill in the required details, agree to the Terms & Conditions, then click Activate

- – Enter the OTP sent via SMS to verify your mobile number

- – You’re done! You’ve successfully activated your Member Gateway account

9. Can I use my registered mobile number if I move to a new company?

Absolutely. You may still log in and access the reimbursement feature. After 30 days, you can reuse the number for a new policy.

10. How do I use the new Member Gateway?

To learn how to navigate the new Member Gateway and explore its features, please refer to this guide: New Member Gateway Member Guide

11. What policies are available on my Member Gateway account?

Effortlessly view and manage all your active or inactive Maxicare policies, including those for yourself and your dependents. You can also securely link additional policies and your dependents’ plans to your Member Gateway account.

12. Who do I contact if I encounter an error?

Easily connect with us through our 24/7 hotline at +632 8582 1900 (PLDT), +632 7798 7777 (GLOBE), or send an email to customercare@maxicare.com.ph.

Reimbursement FAQs

The allowable reimbursement types are the following: Inpatient, outpatient, outpatient medicine, optical, maternity, and dental. You may reach out to your HR or access the employee portal for the HMO benefits included in your policy.

2. What do I have to do to reimburse my bills from availments in non-affiliated hospitals during Emergency cases?

To file for a reimbursement, you will select the “Reimbursement request” option from the “LOA requests & Reimbursement” menu. The system will then guide you on providing the necessary details and uploading required documents for your specific reimbursement type.

Prepare the following documents when filing for reimbursements:

- Duly accomplished Claims Reimbursement Form

- Original Official Receipt/s of the hospital bill/s, including the Statement of Account (SOA) and Charge Slips

- Clinical Abstract of the case, if surgical intervention was performed and its histopathological report

- Operative Record of the case/treatment or admission/discharge record duly signed by the attending Physician.

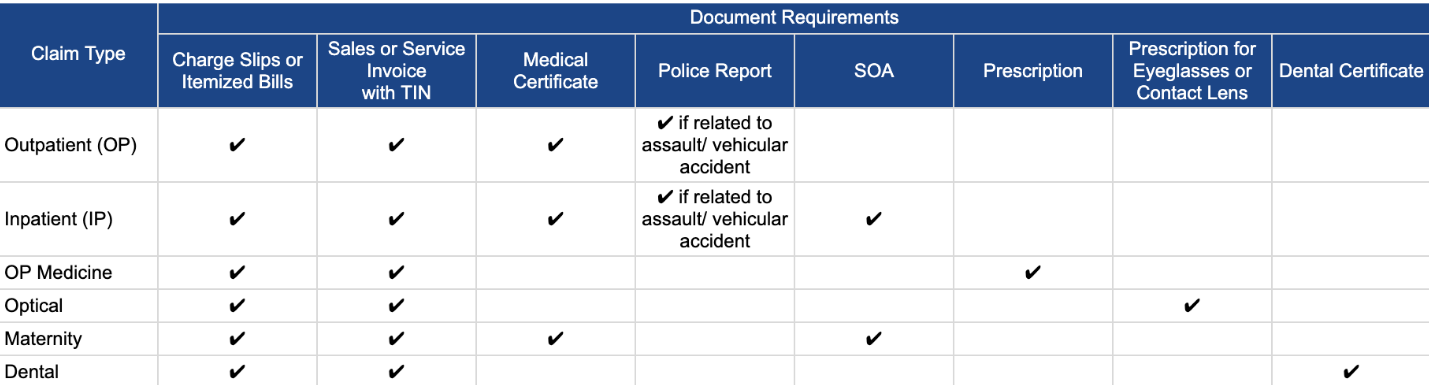

3. What documents are required for reimbursement?

The required documents for reimbursement vary by claim type. To help you prepare, here is a breakdown of the documents needed based on the service you are filing for:

4. How long does it take to process a reimbursement?

Reimbursement requests are usually processed within a maximum of 15 business days.

5. How will I receive my reimbursement (check, direct deposit, etc.)?

Reimbursements will be released through your nominated bank or e-wallet account. This will be collected in the new Member Gateway once your reimbursement is approved.

6. Can I track the status of my reimbursement claim?

Yes, easily track the status of your reimbursement request in the “History” tab under “Reimbursement History”. You’ll also receive in-app, SMS, and email notifications about its status.

7. What bank accounts can be used by a dependent for reimbursement?

- For adult dependents: The adult dependent may use their own bank account, provided that it was the account used when submitting the reimbursement request.

- For minor dependents: Only the principal member can file a reimbursement request for a minor. Therefore, only the principal member’s bank account can be used.

- For guardians of a minor dependent: Guardians do not have access to the new Member Gateway. Reimbursements will be credited to the principal member’s account.

8. What if I don’t have a bank account?

No worries! You may nominate an e-wallet account such as GoTyme, GCash, or Maya.

9. What types of accounts are allowed for reimbursement crediting?

Savings accounts, checking accounts, and e-wallet accounts (e.g., GCash, GoTyme, Maya) are accepted for reimbursement crediting

10. What happens if I entered incorrect bank account details?

To ensure a smooth and successful reimbursement, we kindly ask you to carefully double-check your bank account details before submission. Please note that Maxicare relies on the accuracy of the information you provide and cannot be held liable for any discrepancies or issues resulting from incorrect details.

11. Will I be notified of unsuccessful transactions?

Yes. The system will notify you of any unsuccessful transactions via in-app notification, email, and/or SMS.

12. Do I need to submit a CIF (Customer Identification Form) before submitting a reimbursement request?

No. Submission of a CIF is not required, as reimbursements are credited to your nominated bank or e-wallet account.

13. Who should I contact if I have questions about my reimbursement?

You may connect with us through our 24/7 hotline at +632 8582 1900 (PLDT), +632 7798 7777 (GLOBE), or send an email to customercare@maxicare.com.ph.